IRON CONDOR ZERO

IN OPEN BETA

Neutral Strategy

(selling 0 DTE iron condors)

Iron Condor Zero is a 4-leg option selling strategy that sells put and call credit spreads at the same time, an iron condor.

This strategy:

- Trades $SPX only

- Sells 0 DTE contracts

- Trades on Mondays, Tuesdays, and Fridays

- Sells strikes at the 15 delta

- Creates spreads that are $20 wide

- Lets winner expire worthless

- Stops loss at -150%

- Is pattern day trader (PDT) friendly

Below are the actions the bot is programed to take after activating it on your PeakBot account.

- Open iron condors (sell both a put credit spread and a call credit spread). This occurs every Monday, Tuesday, and Friday around 2:30pm EST.

- The sold strike prices are the 15 delta.

- The spread is set at $20 on both sides of the iron condor.

- By selling a spread, we limit the maximum loss to be the width of the spread less the amount of premium earned at entry. This means your maximum capital at risk roughly $2,000 per iron condor.

- The bot is programed to let winning trades expire so we can capture 100% of the premium earned.

- The bot has a -150% stop loss built in. For example, if you earn $100 at entry, the bot will wait for your position to be worth -$250 and then send a stop loss market order to get you out of the position.

This strategy only trades $SPX. Even though the contracts that the bot opens expire the same day, letting the contracts expire does not count as a day trade.

The only time the bot will day trade is in the instance of a stop loss whereby the bot will open and close the iron condor in the same day. Since the bot only trades 3 out of 5 days of the week, this bot will not make 4 day trades in a 5 rolling day period.

There are some exceptions:

- If you manually day trade yourself or with another bot, this bot will not monitor the number of day trades in your account.

- If the market is closed due to a holiday, you may have to wait an extra day or two to use the bot assuming all previous trades were stopped out.

This strategy only trades $SPX. As $SPX is a cash-settled instrument, you will never be assigned shares.

Your account must fit any of the below set of requirements in order to successfully automate the Iron Condor strategy with PeakBot.

- Broker: Tradier

- Account type: Margin

- Option level: Level 3

- Account minimum: $2,500

- Broker: Schwab

- Account type: Margin

- Option level: Level 2

- Account minimum: $2,500

- Broker: tastytrade

- Account type: Margin

- Option level: Basic

- Account minimum: $2,500

*Past results do not indicate future results

We backtested this bot with the past 2 years of data. Here are the results assuming only 1 iron condor was opened for each trade (data as of 12/6/2024):

Win rate: 74.6%

Longest win streak: 13

Longest loss streak: 4

Average win size: $177

Average loss size: -$305

Annualized return: 283.2%

Monthly P&L (assuming 1 iron condor at a time):

December 2022: $58

January 2023: $974

February 2023: $1,068

March 2023: $1,706

April 2023: $288

May 2023: $1,050

June 2023: -$95

July 2023: $213

August 2023: $1,522

September 2023: $796

October 2023: $2,525

November 2023: $20

December 2023: $1,841

January 2024: -$75

February 2024: $916

March 2024: -$295

April 2024: -$535

May 2024: $474

June 2024: $601

July 2024: $1,727

August 2024: $951

September 2024: $3

October 2024: -$38

November 2024: $74

December 2024: $241

IRON CONDOR

Neutral Strategy

(selling 1 DTE iron condors)

- Iron Condor is a 4-leg option selling strategy that sells put and call credit spreads at the same time.

- Our Iron Condor strategy sells 1 DTE contracts and opens positions every day the market is open.

- Our Iron Condor spreads straddle the 25 delta on each side and are set to a $1 wide spread (with the exception of SPX and NDX which are $5 and $10 spreads respectively).

Below are the actions the bot is programed to take after activating it on your PeakBot account.

- Open Iron Condors (sell both a put credit spread and a call credit spread). This occurs every day around 12pm EST.

- The bot will sell a put credit spread and a call credit spread with strike prices around the 25 delta.

- The spread is set at $1.

- By selling a spread, we limit the maximum loss to be the width of the spread in order to protect your account from a movements in either direction. This means your maximum capital at risk is $100 per iron condor.

- Overnight, the bot is programed to place a GTC limit order of $0.05 to close each leg of the Iron Condor separately (both the call spread and the put spread).

- If any leg of the Iron Condor is still open at 3:45pm EST on the day of expiration, the bot is programed to cancel the existing GTC limit order and close the leg with a market order. We do this in order to avoid any chances of assignment.

This strategy is designed to avoid assignments. However, if for some reason you are assigned shares, the bot will not automatically handle assignment of shares. Please note, it is up to you to manually handle positions after assignments.

Your account must fit any of the below set of requirements in order to successfully automate the Iron Condor strategy with PeakBot.

- Broker: Tradier

- Account type: Margin

- Option level: Level 3

- Account value: $2,000

- Broker: Schwab

- Account type: Margin

- Option level: Level 2

- Account value: $2,000

- Broker: tastytrade

- Account type: Margin

- Option level: Basic

- Account value: $2,000

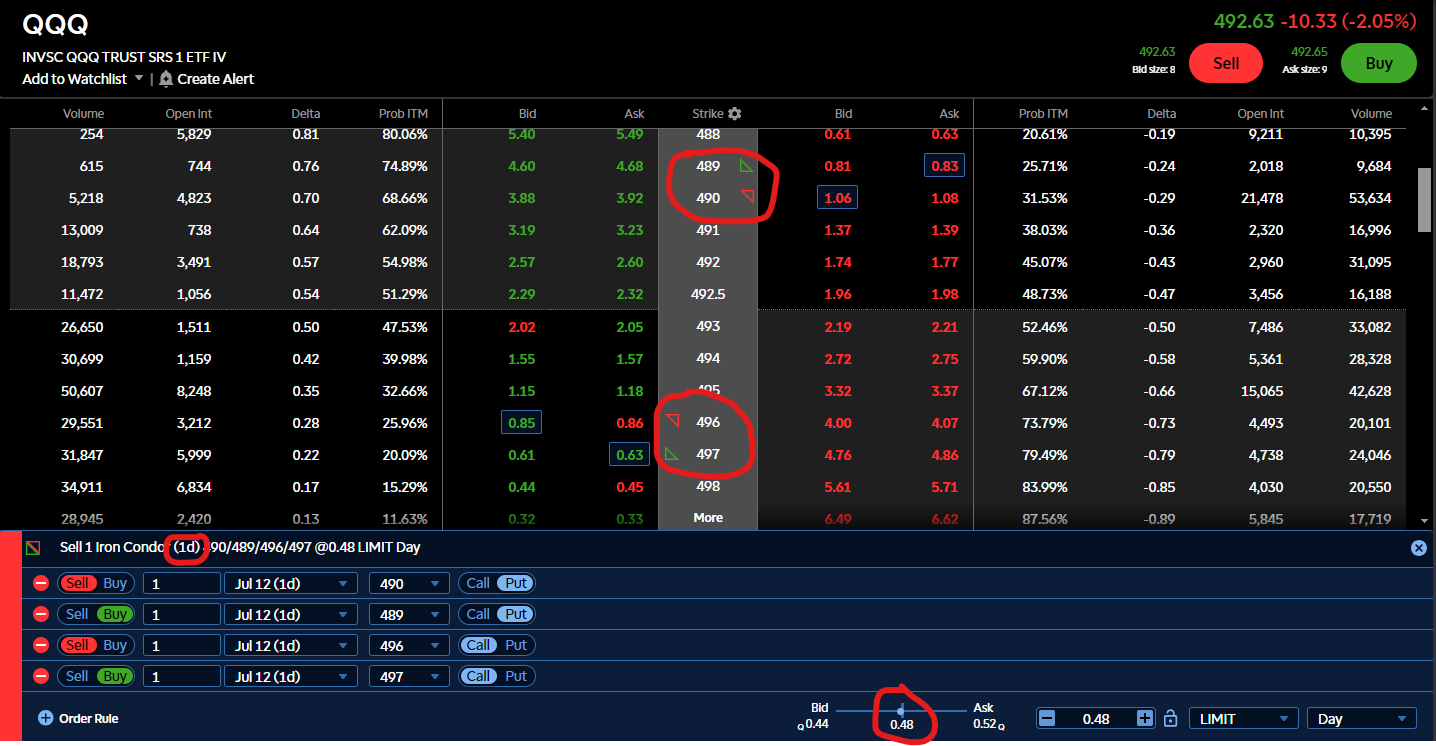

The below screenshot illustrates strike prices around the 25 delta.

Please reference the below trade set up to understand the 2 closing scenarios that can take place when automating the Iron Condor. For these scenarios, we use the ticker QQQ and will assume the we sold the $490 and $496 strikes and we bought the $489 and $497 strikes.

In order to make this trade, we only need $100 per contract because our spread is set at $1.

As a results of the trade, we receive a credit of $0.48. When multiplied by the 1 contract traded, the total credit (before fees) comes to $48.

- Closing at $0.05

- If on the day of expiration, the value of the put credit spread falls to $0.05 or lower, the bot will close the put credit spread leg. If the value of the call credit spread falls to $0.05 or lower, the bot will close the call credit spread leg.

- Closing at Market

- If on the day of expiration, either side of the Iron Condor is still open, the bot is programmed to close that leg with a market order in order to avoid assignment.

The ideal scenario is that both legs close at $0.05.

TREND SPREAD

Multi-Directional Strategy

Bullish, Bearish, Neutral

(selling weekly spreads)

- The Trend Spread option selling strategy sells put credit spreads, call credit spreads, or Iron Condors (depending on trend direction) to consistently collect premiums.

- We've compiled a watchlist that details the stocks available to automate as well as information on expected premiums.

Below are the actions the bot will take after setting it up on your PeakBot account.

- Selling spreads: This occurs primarily on Fridays with secondary entries possible on Mondays and Tuesdays between 12pm-2pm EST.

- The bot will sell a contract at the strike that is closest to and greater than the 30 delta.

- The bot will also buy a contract at the strike that is closest to and greater than the 10 delta to create a spread.

- The bot will not place an order to sell a spread if the estimated credit on the trade is less than $5 per contract.

- By selling a spread, we limit the maximum loss to be the width of the spread in order to protect your account from a large drawdown.

Trend direction:

The trend direction will determine the type of spread PeakBot will place on your behalf.

- A bullish trend is triggered when the 67 Day EMA trends up at least 2 of the last 3 & 6 of the last 10 days. A put credit spread order will be placed in a bullish trend.

- A bearish trend is triggered when the 67 EMA trends down at least 2 of the last 3 & 6 of the last 10 trading days. A call credit spread order will be placed in a bearish trend.

- A neutral trend is considered if the trend is neither bullish nor bearish. An Iron Condor order will be placed in a neutral trend.

This strategy is designed to avoid assignments. There may be instances where you are assigned shares before the expiration date. In these cases, you are responsible for handling that position manually; PeakBot assumes no responsibility for positions outside of the strategy boundaries. There may also be instances where a position does not close on the day of expiration, this is likely due to the sold contract being so far out of the money that there is no liquidity.

Additionally, if you wish to stop trading a ticker, you can either let your current position expire, manually close out of the position, or select the 'Smart Exit' feature for that ticker within your PeakBot account.

Your account must fit any of the below set of requirements in order to successfully automate the Trend Spread strategy with PeakBot.

- Broker: Tradier

- Account type: Margin

- Option level: Level 3

- Account minimum: $2,000

- Broker: Schwab

- Account type: Margin

- Option level: Level 2

- Account minimum: $2,000

- Broker: tastytrade

- Account type: Margin

- Option level: Basic

- Account minimum: $2,000

WHEEL

HEDGED

Bullish to Neutral Strategy

(selling weekly spreads)

- The Wheel option selling strategy sells cash-secured puts & covered calls to consistently collect premiums.

- Our version of the Wheel sells credit spreads instead of selling naked (see Description below).

- We've compiled a watchlist that details the stocks available to automate as well as information on expected premiums.

Below are the actions the bot will take after setting it up on your PeakBot account.

- Check the stock you added to your Automated Portfolio to determine if shares are already owned.

- If under 100 shares are owned, the bot will start by automatically selling put credit spreads.

- If over 100 shares are owned, the bot will start by automatically selling combo credit spreads.

- Selling put credit spreads: This occurs on Mondays and Tuesdays between 11am-1pm EST.

- The bot will sell a put at the strike that is closest to and greater than the 30 delta.

- The bot will also buy a put at the strike that is closest to and greater than the 10 delta to create a spread.

- The bot will not place an order to sell a spread if the estimated credit on the trade is less than $5 per contract.

- By selling a spread, we limit the maximum loss to be the width of the spread in order to protect your account from a large drawdown.

- Selling combo credit spreads: This also occurs on Mondays and Tuesdays between 11am-1pm EST.

- The bot will sell a call at the strike that is closest to and less than the 30 delta.

- The bot will also buy a protective put at the strike that is closest to and less than the 10 delta to create a spread.

Note: We do allow a feature for expert traders to turn off the hedge and sell naked options. Please contact us for more details if interested.

This strategy is designed to automatically handle assignment of shares. Please see the below scenarios for details.

- When trading a put spread, if the stock price is greater than the bought put and less than the sold put at expiration, you will be assigned 100 shares per contract at the strike price of your sold put. You will need enough cash in your account to purchase these shares. When assigned shares, the bot will automatically start selling call credit spreads for you during the next trading window.

- When trading a combo spread, if the stock price is greater than the sold call at expiration, your shares of stock will be automatically sold (called away) at the strike price of your sold call. You will need enough shares in your account in the scenario they get called away.When shares are called away, the bot will automatically start selling put credit spreads for you during the next trading window.

Note, for more detail, please see the example trades below.

Your account must fit any of the below set of requirements in order to successfully automate the Wheel strategy with PeakBot.

- Broker: Tradier

- Account type: Margin

- Option level: Level 3

- Account value: $2,000

- Broker: Schwab

- Account type: Margin

- Option level: Level 2

- Account value: $2,000

- Broker: tastytrade

- Account type: Margin

- Option level: Basic

- Account value: $2,000

If you choose to automate this strategy 'naked' (expert traders only)

- Broker: Tradier

- Account type: Cash

- Option level: Level 1

- Account value: No minimum

- Broker: Tradier

- Account type: Margin

- Option level: Level 4

- Account value: $10,000 minimum

- Broker: Schwab

- Account type: Margin or cash

- Option level: Level 1

- Account value: $2,000

- Broker: tastytrade

- Account type: Margin or cash

- Option level: Limited

- Account value: $2,000

Put Credit Spread Scenarios:

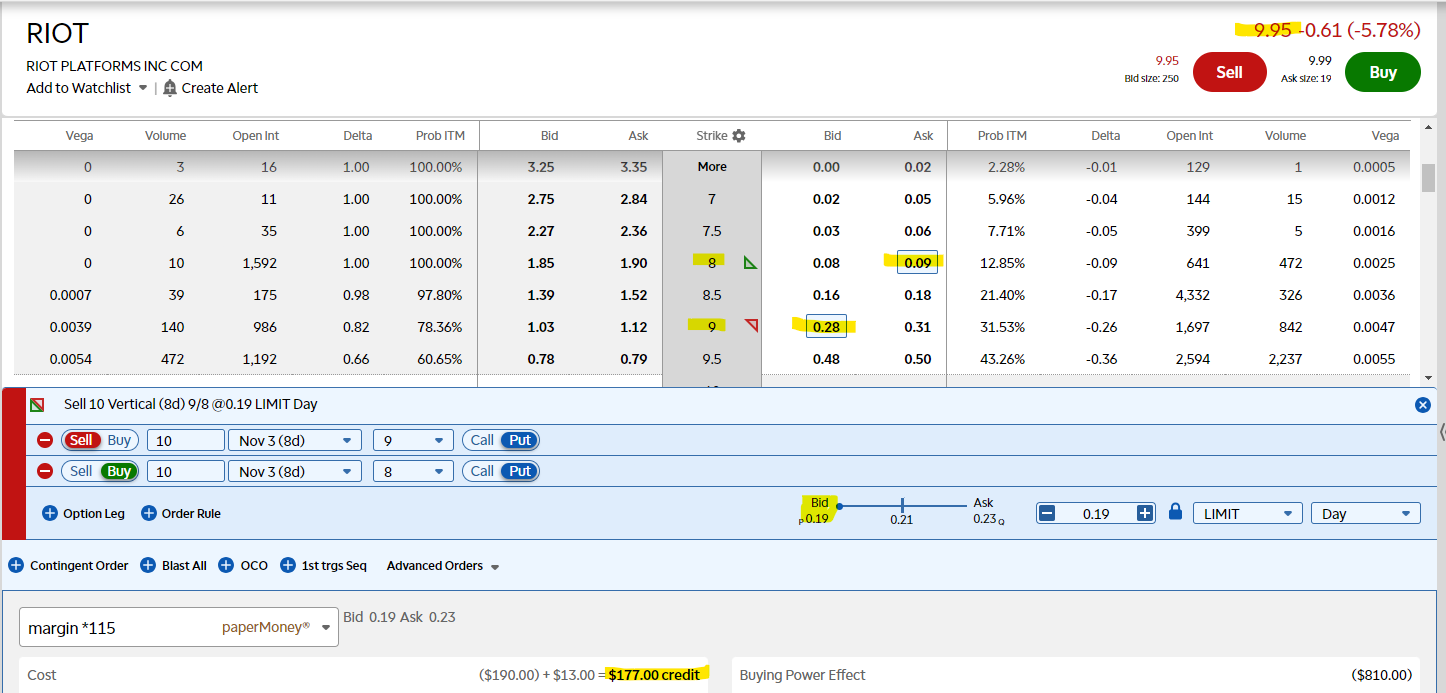

Please reference the below trade set up to understand the 3 potential outcomes for a put credit spread. For these scenarios, we use the ticker RIOT and will assume the we sold the $9 strike and we bought the $8 strike.

In order to make this trade, we are willing to secure $9,000 (the $9 sold strike multiplied by 10 contracts) of capital to purchase 1000 shares in the case of assignment (scenario #2).

As a results of the trade, we receive a credit of $0.19. When multiplied across the 10 contracts of the trade, the total credit (after fees) comes to $177, roughly a 1.9% return on your cash secured in just one week.

- Expiring Worthless

- If on the day of expiration, RIOT's stock price closes above $9 (which is our sold put strike), we keep the full $177 credit and will sell a put credit spread again next week.

- Getting Assigned

- If on the day of expiration, RIOT's stock price closes between $8 and $9 (the strikes at which we set our spread), we will be assigned 100 shares per contract and will sell acombo credit spread next week.

- Limiting Loss

- If on the day of expiration, RIOT's stock price closes below $8 (outside of our spread), we will experience a loss that is equal to the width of the spread multiplied by 100 (because there are 100 shares per contract), multiplied by the number of contracts held. In this case, the spread was $1 wide and we would realize a loss of $1,000 because we're trading 10 contracts. This spread protects your account from extreme downside. Based on the delta bought, there is statistically, roughly a 10% chance that this will happen on each trade. Next week the bot will sell a put credit spread.

Combo Credit Spread Scenarios:

Please reference the below trade set up to understand the 3 potential outcomes for a combo credit spread. For these scenarios, we use the ticker RIOT and will assume the we sold the $10.5 call strike and we bought the $8 put strike.

In order to make this trade, we must own 1000 shares of RIOT in the case the shares are called away (scenario #2).

As a results of the trade, we receive a credit of $0.20. When multiplied across the 10 contracts of the trade, the total credit (after fees) comes to $187, roughly a 1.9% return on the assumed price paid for the shares.

- Expiring Worthless

- If on the day of expiration, RIOT's stock price closes below $10.5 (which is our sold call strike) and above $8 (which is our bought put strike), we keep the full $187 credit, we keep the 1000 shares that we own and will sell a combo credit spread again next week.

- Shares Called Away

- If on the day of expiration, RIOT's stock price closes above $10.5, our 1000 shares will get called away (we will be forced to sell) at $10.50 per share and will sell a put credit spread next week.

- Downside Protection

- If on the day of expiration, RIOT's stock price closes below $8, our 1000 shares will get sold at $8 per share and next week the bot will sell a put credit spread.

In all scenarios, the bot will sell the bought call on the day of expiration.